awaka.online Tools

Tools

Current Car Loan Rates By Credit Score

Understanding your credit history and current credit score may help you make a more informed decision on your auto loan. Credit scores are a key factor when. Auto Loans. Financing and refinancing options for your new or used vehicle. Apply Online Loan By Phone Current Rates. Home; Loans & Credit; Loans; Auto Loans. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Auto and Harley Davidson Motorcycle Loan Rates Payment example: term of 63 months, % APR, min credit score ; estimated monthly payment of $ per. Shopping around for an auto loan generally has little to no impact on your credit score if you complete the rate shopping and get a loan within 45 days. For. See your rate, terms and payment amount – with no impact to your credit score. % off current Patelco Credit Union rate with a max loan term of 72 months. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Car loan rates by credit score. When you apply for a car loan, auto dealers may pull from either your VantageScore or FICO score, both of which have slightly. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %. Understanding your credit history and current credit score may help you make a more informed decision on your auto loan. Credit scores are a key factor when. Auto Loans. Financing and refinancing options for your new or used vehicle. Apply Online Loan By Phone Current Rates. Home; Loans & Credit; Loans; Auto Loans. View and compare current auto loan rates for new and used cars, and discover options that may help you save money. Apply online today at Bank of America. Auto and Harley Davidson Motorcycle Loan Rates Payment example: term of 63 months, % APR, min credit score ; estimated monthly payment of $ per. Shopping around for an auto loan generally has little to no impact on your credit score if you complete the rate shopping and get a loan within 45 days. For. See your rate, terms and payment amount – with no impact to your credit score. % off current Patelco Credit Union rate with a max loan term of 72 months. The latest average APR rates for a new car is %, and for a used car are % if you have a Nonprime credit rating. These can vary depending on the length. Car loan rates by credit score. When you apply for a car loan, auto dealers may pull from either your VantageScore or FICO score, both of which have slightly. Average Auto Loan Rates for Excellent Credit ; Credit Score, New Car Loan, Used Car Loan ; or higher, %, %.

New/Used Auto financing available up to % Loan to Value ; %, %, %, % ; %, %, %, %. Rates as of Sep 09, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. View your current Vehicle Loan rates. ; Autos – Used (Model Year to ), % ; Autos – Used (Model Year to ), % ; Boats & RVs – New ( to. Minimum credit score of required to qualify for promotion. Vehicle must be a or newer. Existing 1st Advantage loans are not eligible for refinance. Not. Car Loan APRs by Credit Score. As of , the average interest rate for car loans was percent for new cars and percent for used cars. However, these. Compare auto loan rates in September ; PenFed Credit Union, Starting at %, months, Not specified, Bankrate Award winner for best auto loan. Mission Fed will help you buy your next vehicle. With competitive auto loan rates, flexible terms, knowledgeable specialists and resources you can shop with. Those with lower credit scores, from to , were % APR for new loans and % APR on used auto loans, which are significantly higher. It is. You could save on interest by refinancing your current auto loan to a lower rate at Alliant. How to get your credit union car loan. You could get a competitive. Automobile Loans ; New and Current Used · · * * * · % % % % ; Two-Year-Old Vehicles · · * * * · % %. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. % today. Along with your score, there are other factors that are looked at as well in terms of the vehicle cost, age, mileage, and condition. Compare car loans from multiple lenders to find the best rate · Navy Federal Credit Union: Best car loan for those with military connections · Southeast Financial. New and Used auto interest rates change over time, but you can access current rates anytime online through UW Credit Union. Check loan rates for Autos. Current vehicle loan rates. Check the latest interest rates for auto Even with an excellent credit score, car loan rates for used vehicles may be. Car loan rates by credit score. When you apply for a car loan, auto dealers may pull from either your VantageScore or FICO score, both of which have slightly. Auto Loan Rates ; New - · - , up to 65, %, % ; Used - · - , up to 65, %, % ; Used - · - , up. Rates range from % APR to % APR. The % APR is available to members with credit scores ranging from to Rate and term are current as of. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. What credit score is needed to buy a. See current PSECU car loan rates. Use the PSECU car loan calculator to estimate a payment. Explore the latest PSECU new car loan and used car loan options.

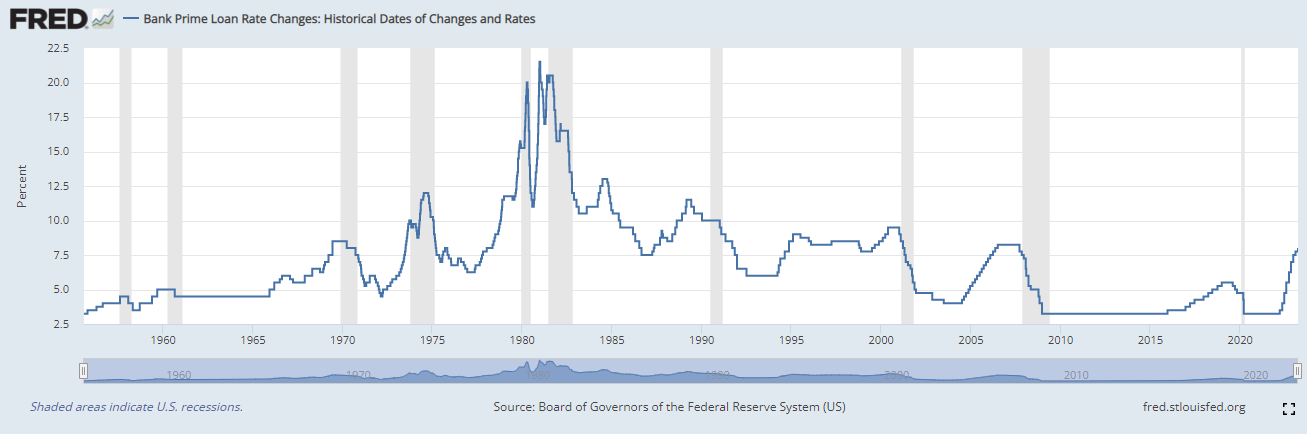

What Is The Rate Of Prime

The prime rate helps financial institutions establish how much interest to charge borrowers. The prime interest rate is the reference rate used by financial institutions to determine the variable interest rate they will offer for loans to businesses. The prime rate is the interest rate that commercial banks charge creditworthy customers and is based on the Federal Reserve's federal funds overnight rate. The U.S. prime rate is in principle the interest rate at which a supermajority (3/4ths) of large banks loan money to their most creditworthy corporate. % – Effective as of: September 12, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. The US Bank Prime Loan Rate measures the rate at which banks lend to their clients. The prime rate is correlated with the federal funds rate and tends to move. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/ US prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest US banks, and is effective 7/27/ It's a benchmark set and used by financial institutions to determine how much interest to charge a bank's customers on loans. Typically, it's about 3% higher. The prime rate helps financial institutions establish how much interest to charge borrowers. The prime interest rate is the reference rate used by financial institutions to determine the variable interest rate they will offer for loans to businesses. The prime rate is the interest rate that commercial banks charge creditworthy customers and is based on the Federal Reserve's federal funds overnight rate. The U.S. prime rate is in principle the interest rate at which a supermajority (3/4ths) of large banks loan money to their most creditworthy corporate. % – Effective as of: September 12, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different. The US Bank Prime Loan Rate measures the rate at which banks lend to their clients. The prime rate is correlated with the federal funds rate and tends to move. Historical Prime Rate ; · 7/27/, % ; · 12/16/, % ; · 6/29/, % ; · 2/3/, % ; · 11/15/ US prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest US banks, and is effective 7/27/ It's a benchmark set and used by financial institutions to determine how much interest to charge a bank's customers on loans. Typically, it's about 3% higher.

What is the current prime rate? The current prime rate among major U.S. banks is %. The prime rate normally runs three percentage points above the central. Graph and download economic data for Bank Prime Loan Rate (DPRIME) from to about prime, loans, interest rate, banks, interest. A bank's prime rate is based on the Bank of Canada's overnight rate, also referred to as the policy interest rate. The overnight policy changes impact the prime. In depth view into Bank Prime Loan Rate including historical data from to , charts and stats. The current Bank of America, N.A. prime rate is % (rate effective as of July 27, ). The prime rate is the current interest rate that financial institutions in the U.S. charge their best customers. These customers have excellent credit. The prime rate meaningis the interest rate that a bank charges its most reliable, creditworthy non-bank customers for loans or debt instruments. The term prime rate refers to the interest rate that large commercial banks charge on loans and products held by their customers with the highest credit. The prime rate is typically 3% higher than the federal funds rate, which is the interest rate that banks charge other institutions to borrow money. Prime rate or prime lending refers to the lowest commercial interest rate charged by a banks at a particular time. It is also used as the reference rate for the. The current prime rate is %. It last changed on July 27, Data source: Wall Street Journal (print edition). Prime plus spread, also known as prime rate or prime lending rate, refers to the interest rate that banks charge their most creditworthy customers for. The prime rate is % as of July , according to the Fed. This is the lowest rate in the past year and since The prime rate is a type of interest rate that is set by banks and lenders as a baseline for what APR they want to charge. The prime interest rate is the interest rate banks charge their most favored customers. It is based on the federal funds rate. Current Prime Rate, Prime Rate History, Prime Rate Forecast, SITEMAP, Prime Rate Chart, Credit Card Search, Economy, Life Insurance, LIBOR Rates MONTHLY. Graph and download economic data for Bank Prime Loan Rate (MPRIME) from Jan to Aug about prime, loans, interest rate, banks, interest. Bank Lending Rate in the United States remained unchanged at percent in June. This page provides - United States Average Monthly Prime Lending Rate. Prime rate A prime rate or prime lending rate is an interest rate used by banks, usually the interest rate at which banks lend to customers with good credit. Prime rate or prime lending refers to the lowest commercial interest rate charged by a banks at a particular time. It is also used as the reference rate for the.

Whats Cpa

A CPA, or Certified Public Accountant, is a trusted financial advisor who helps individuals, businesses, and other organizations plan and reach their financial. A CPA's salary usually reaches the high five figures while senior CPAs in management can earn a six-figure salary. A certified public accountant (CPA), however, is someone who has earned a professional designation through a combination of education, experience and licensing. Our Mission. The public's need for accounting services of a high quality gave rise to the designation “Certified Public Accountant (CPA)” as a means of. A CPA is a Certified Public Accountant - someone licensed by the state to practice public accounting. To earn this license, you'll need to meet your state's. CPA, which stands for Certified Public Accountant, is a professional accounting qualification acknowledged globally and provided by The American Institute of. CPAs are distinguished accounting professionals committed to protecting the public interest. They provide financial reports, statements, audits and other. What is the Uniform CPA Examination? CPAbrochurelogo The Uniform Certified Public Accountant (CPA) Examination is developed by the AICPA with significant input. A CPA is a certified public accountant who is licensed by a state board of accountancy. To earn the prestige associated with the CPA license, you are required. A CPA, or Certified Public Accountant, is a trusted financial advisor who helps individuals, businesses, and other organizations plan and reach their financial. A CPA's salary usually reaches the high five figures while senior CPAs in management can earn a six-figure salary. A certified public accountant (CPA), however, is someone who has earned a professional designation through a combination of education, experience and licensing. Our Mission. The public's need for accounting services of a high quality gave rise to the designation “Certified Public Accountant (CPA)” as a means of. A CPA is a Certified Public Accountant - someone licensed by the state to practice public accounting. To earn this license, you'll need to meet your state's. CPA, which stands for Certified Public Accountant, is a professional accounting qualification acknowledged globally and provided by The American Institute of. CPAs are distinguished accounting professionals committed to protecting the public interest. They provide financial reports, statements, audits and other. What is the Uniform CPA Examination? CPAbrochurelogo The Uniform Certified Public Accountant (CPA) Examination is developed by the AICPA with significant input. A CPA is a certified public accountant who is licensed by a state board of accountancy. To earn the prestige associated with the CPA license, you are required.

To become a CPA, you'll need to be licensed by a state board of accountancy. And to become licensed, you'll need to pass the uniform CPA exam. An accountant is someone who completed a Bachelor degree in accounting, whereas a CPA is an accountant who has earned their CPA licence through ongoing higher. CPAs are trained to understand and manage a host of complex financial issues, from filing taxes to internal auditing. CPAs work at all levels of government providing accounting expertise to guide financial planning and to maintain fiscal control. Roles include tax auditors. Everything you need to know about the CPA Exam. To become a licensed CPA, you must pass the CPA Exam, a four-section, hour assessment. CPA Canada is the national organization established to support a unified Canadian accounting profession, governed by a Board of Directors and led by CPA. CPA is an acronym for Certified Public Accountant. While a CPA is an accountant, not every accountant is a CPA. A CPA is not the same as an accountant. An accountant is typically a professional who has earned a bachelor's degree in accounting. A CPA, or Certified Public. CPAs are entrusted with critical tasks such as auditing financial statements, advising on tax matters, and guiding strategic financial planning for businesses. A place for upcoming and newly minted CPAs to learn the truth about the accounting profession. A CPA is an accounting professional responsible for helping businesses, individuals, or government entities maintain viability. CPAs file taxes, audit. Public accountants work for individuals, businesses, or the government and may specialize in areas such as taxation, consulting, or auditing. To become a CPA, you'll need to be licensed by a state board of accountancy. And to become licensed, you'll need to pass the uniform CPA exam. All CPAs are accountants, however not all accountants are CPAs—that's because factors such as licensing, their function, skills, and more differ them. This guide explains the process of obtaining and maintaining CPA certification. It also explores the benefits of this optional but valuable professional. What is the Uniform CPA Examination? CPAbrochurelogo The Uniform Certified Public Accountant (CPA) Examination is developed by the AICPA with significant input. A Certified Public Accountant (CPA) is a professional accountant who has met specific education, experience, and examination requirements. To obtain the required body of knowledge and to develop the skills and abilities needed to be successful CPAs, students should complete semester hours of. CPA Australia is one of the world's largest accounting bodies. An international, interconnected member organisation. What is the CPA Exam? The Uniform CPA Examination is the first step toward obtaining licensure as a Certified Public Accountant (CPA). This four-section exam is.

What Do You Need To Build Credit

A strong credit history, reflected in good credit scores, will let you qualify for lower interest rates and fees, freeing up additional money to set aside for. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card. If you're ready to establish your credit, a secured credit-builder loan or. Become an authorized user; Try a credit-building debit card; Apply for a secured credit card; Apply for a credit-builder loan; Apply for a store credit card. Smart Credit Building Tips · Charge wisely: A smart way to start building your credit history is to ensure that you never charge more than you can pay off in a. Payment History: This is what lenders care about most. Do you pay your bills on time? Payment history has the biggest impact on your credit score. Amounts owed. Then, set up autopay so you never miss a payment. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your. Paying on time, maintaining a mix of different types of accounts and keeping your balances low can all help ensure that the history you establish is positive. Open a secured credit card. If you are unable to get approved for a traditional credit card, a secured credit card can help you build your credit history. This. With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. A strong credit history, reflected in good credit scores, will let you qualify for lower interest rates and fees, freeing up additional money to set aside for. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card. If you're ready to establish your credit, a secured credit-builder loan or. Become an authorized user; Try a credit-building debit card; Apply for a secured credit card; Apply for a credit-builder loan; Apply for a store credit card. Smart Credit Building Tips · Charge wisely: A smart way to start building your credit history is to ensure that you never charge more than you can pay off in a. Payment History: This is what lenders care about most. Do you pay your bills on time? Payment history has the biggest impact on your credit score. Amounts owed. Then, set up autopay so you never miss a payment. Even if you tuck the card away, those monthly transactions and on-time payments should help you on your. Paying on time, maintaining a mix of different types of accounts and keeping your balances low can all help ensure that the history you establish is positive. Open a secured credit card. If you are unable to get approved for a traditional credit card, a secured credit card can help you build your credit history. This. With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score.

You might also consider a secured card. With these cards, you make a security deposit in advance for the amount you want to borrow. This gives the bank. An installment loan requires you to repay the borrowed amount with a fixed monthly payment. Types of installment loans include student loans, personal loans. Key takeaways · Stay informed. You need to know what's on your credit report and how it's affecting your score. · Options like a secured credit card or. The most important thing you can do to build credit with a credit card is to make your monthly payments on time. Payment history makes up 35% of your credit. Understanding Your FICO Score · Keep Paying Old Bills · Report Your Rent · Take a Loan · Open a Store Credit Account · Check With Your Utility Company · Keep Your Job. No, you don't need a credit card to build your credit score, but it helps. There are 5 factors to determining your credit scores. Payment. Yes, credit cards to build credit but debit cards do not. You're paying off any purchases you make on the credit card, you can pretty much put. To get certain types of loans, such as a mortgage, you need to have a good or excellent credit score and a strong credit report to qualify for the best terms. Credit-builder loans are just what they sound like—loans for people who want to improve their credit score by building a consistent payment history. These loans. How do you build or establish credit? · Secured credit cards. Secured credit cards are designed to help the user build credit history, making them a perfect. Another way to build credit is to become an authorized user on the credit card of a trusted family member or friend. While authorized users have access to an. Get a secured credit card. It's great for new folks and new to country folks. Essentially a debit card that builds credit. When you can, get a. Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial. Not all lenders use the same score, but in general, you should shoot for a score of or higher. Building a good credit score means you can borrow money at. We do not have control over your credit scores generated by the credit bureaus. Even when we report positive credit history on your Step Visa card, your. To qualify for a FICO® Score, you'll need to have at least one account open for at least six months, and it must have been reported to the credit bureaus within. How To Build a Credit History · Apply for a Secured Credit Card · Become an Authorized User · Find a Co-Signer · Use Store Credit Cards · Warning · Finance With. Building credit takes time. There's nothing that you can do that will take you from no credit score to excellent credit overnight. You simply need to add new. Whether you're seeking a mortgage, taking out a loan or renting a new apartment, you should know how essential it is to have a good credit score. For many. How to build credit fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5.

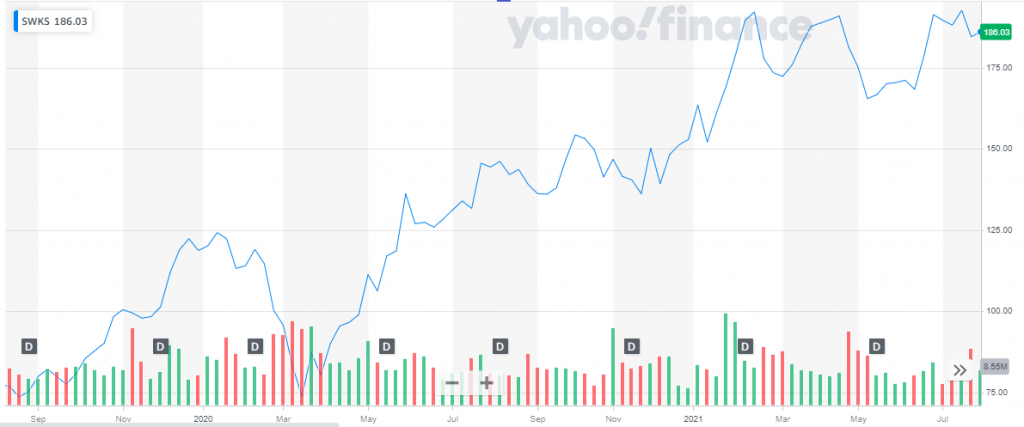

5g Small Company Stocks

CALF. Pacer US Small Cap Cash Cows ETF. The Trendpilot® Series aims to “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by. It serves small and medium businesses, enterprises, and wholesale and government customers. The company was formerly known as Webcentral Limited and changed its. #1 FROG CELLSAT; #2 STERLITE TECH; #3 HFCL; #4 TEJAS NETWORKS; #5 INDUS TOWERS. When should you invest in 5G stocks? The internet, bank regulations, and customer choices now dictate how companies will be run in the future. Financial health and growth are concerns. 12 5G Penny Stocks to Watch · Advanced Semiconductor Engineering (ADR) (NYSE:ASX) · Telefonaktiebolaget LM Ericsson (ADR) (NASDAQ:ERIC) · Globalstar, Inc (NASDAQ. CALF. Pacer US Small Cap Cash Cows ETF. The Trendpilot® Series aims to “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by. The BlueStar 5G Communications Index is a rules based index that tracks the performance of a group of US-listed stocks, of global companies that are involved in. Equity Risk: Stock markets can be volatile and stock prices can change substantially · Market Risk · Emerging Markets Risk · Liquidity Risk · Smaller Companies Risk. Fujitsu Limited, CommScope Holding Company, Inc., Comba Telecom, Systems Holdings Limited, Mavenir, and Airspan Networks Holdings Inc., are some of the emerging. CALF. Pacer US Small Cap Cash Cows ETF. The Trendpilot® Series aims to “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by. It serves small and medium businesses, enterprises, and wholesale and government customers. The company was formerly known as Webcentral Limited and changed its. #1 FROG CELLSAT; #2 STERLITE TECH; #3 HFCL; #4 TEJAS NETWORKS; #5 INDUS TOWERS. When should you invest in 5G stocks? The internet, bank regulations, and customer choices now dictate how companies will be run in the future. Financial health and growth are concerns. 12 5G Penny Stocks to Watch · Advanced Semiconductor Engineering (ADR) (NYSE:ASX) · Telefonaktiebolaget LM Ericsson (ADR) (NASDAQ:ERIC) · Globalstar, Inc (NASDAQ. CALF. Pacer US Small Cap Cash Cows ETF. The Trendpilot® Series aims to “FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by. The BlueStar 5G Communications Index is a rules based index that tracks the performance of a group of US-listed stocks, of global companies that are involved in. Equity Risk: Stock markets can be volatile and stock prices can change substantially · Market Risk · Emerging Markets Risk · Liquidity Risk · Smaller Companies Risk. Fujitsu Limited, CommScope Holding Company, Inc., Comba Telecom, Systems Holdings Limited, Mavenir, and Airspan Networks Holdings Inc., are some of the emerging.

The future of defense innovation will be a combination of commercial and government-driven technology, large and small company innovation and academic research. Up to times faster than 4G, 5G is creating never-before-seen opportunities for people and businesses. Faster connectivity speeds, ultra-low latency and. Stock Information · Company Profile · Corporate Governance · Other Services · Career 5G Small Cell. 4G Router · 5G Router. Key Features. • 5G Mobility • 5G Networks Limited. (ASX: 5GN) latest news, share price, company information, stock chart and announcements on Australia's #1 site for investors. 5G Stocks List (Providers) · 1. AT&T Inc (NYSE: T) · 2. Verizon Communications (NYSE: VZ) · 3. T-Mobile US Inc (NASDAQ: TMUS). Thus, some hyped-up telecom companies that surged during the 5G rollout might become 5G stocks to sell. small businesses and residential users but still. Tech Mahindra is an IT company which deals in Network deployment. It will benefit immensely from 5G rollout. Not just in India but in other. We're trusted by service providers large and small to power the present and to fast-forward them to 5G. Company. About Us · Blog · Careers · Corporate. The stock was selling for around $16 a share, and the dividend was a lofty 15%. “That dividend was completely covered by one big contract the company had. And. Small Business Program · Climate Protection Climate Protection. Overview Company · What We Do; 5G. The network America relies on. Welcome to the fully. When it comes to Canadian 5G stocks, there's a lot to consider. Companies like Shaw Communications and BCE Inc. are making significant strides in 5G. businesses. It serves small and medium businesses, enterprises, and wholesale and government customers. The company was formerly known as Webcentral Limited. We knew from an early stage that 5G would make digitalization more accessible, allowing small businesses, public services and even individual households to reap. votes, comments. Small cap and micro cap stocks have 5g smartphone already in your pocket, nothing extra. Dont mind that. The Small Cell 5G Network Market is growing at a CAGR of 37% over the next 5 years. Nokia Networks, Qualcomm Technologies Inc., Huawei Technologies Co. 5G for business: Samsung's vision & commitment Picture artificial intelligence (AI) applied to everyday life. Picture IoT, smart cities and connected vehicles. Small cell radios play a crucial role in enhancing coverage and capacity, supporting demanding 5G applications such as enterprise operations, VR, AR and gaming. Explore Authentic Small Cell 5g Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. A 5G stock is a publicly traded common stock of a company that sells a product or service related to 5G. Not all 5G companies have it as its primary product. Discover investing Ideas and stock themes on Trade Brains Portal Buckets Feature.

Shipping From Utah To California

View rates from USPS, UPS and FedEx between salt lake city and los angeles. If you want to print a shipping label, try Easyship to handle your small. Utah freight rates Utah freight shipping is affordable, especially truckload freight rates. California. The ease and cost of shipping into or out of Utah can. You can compare Utah to California freight rates with our easy-to-use freight quote tool and find a carrier that meets your pricing and shipping needs. Ask our. This map will provide you with expected 1, 2, or 3 day delivery areas for Priority Mail® shipments. Exceptions apply and delivery time is not guaranteed. delivery anywhere within California and the major metropolitan areas of Arizona, Nevada, Oregon, Washington, Utah, Colorado and Idaho.* Get next-day. Depending on a few factors, such as the container size, cargo weight, and volume, the price can range from $1, to $10, It's essential to keep these. Obtain a rapid rate on freight moving from Utah to California by filling out our contact form or by giving FreightPros a call. Check out our blog for Austin. Shipping freight from California to Utah is now made easier than ever because of FreightCenter's competitive freight quotes. We have constructed a simple, easy-. UPS's shipping calculator estimates the time and cost of delivery based on the destination and service. Get a quote for your next shipment. View rates from USPS, UPS and FedEx between salt lake city and los angeles. If you want to print a shipping label, try Easyship to handle your small. Utah freight rates Utah freight shipping is affordable, especially truckload freight rates. California. The ease and cost of shipping into or out of Utah can. You can compare Utah to California freight rates with our easy-to-use freight quote tool and find a carrier that meets your pricing and shipping needs. Ask our. This map will provide you with expected 1, 2, or 3 day delivery areas for Priority Mail® shipments. Exceptions apply and delivery time is not guaranteed. delivery anywhere within California and the major metropolitan areas of Arizona, Nevada, Oregon, Washington, Utah, Colorado and Idaho.* Get next-day. Depending on a few factors, such as the container size, cargo weight, and volume, the price can range from $1, to $10, It's essential to keep these. Obtain a rapid rate on freight moving from Utah to California by filling out our contact form or by giving FreightPros a call. Check out our blog for Austin. Shipping freight from California to Utah is now made easier than ever because of FreightCenter's competitive freight quotes. We have constructed a simple, easy-. UPS's shipping calculator estimates the time and cost of delivery based on the destination and service. Get a quote for your next shipment.

Generally, it may take between 2 to 7 days for your car to be delivered from Utah to California. The shipping time to transport a car from Utah to California. When using UPS Ground or 3 Day Select services, the shipping price ranges between $50 to $ Furthermore, the delivery time is business days. On the other. Generally, it may take between 2 to 7 days for your car to be delivered from Utah to California. The shipping time to transport a car from Utah to California. Freight rates from California to Utah and freight shipping quotes from CA to UT from FreightPros' team of Truckload & LTL experts. Use our online tool to estimate UPS® shipping costs. The UPS Store Downtown Slc is ready to help pack and ship your items. California to help you learn how much it costs to ship a package. So, we recommend you find the best delivery prices using our online shipping calculator. Transport your Equipment from Utah to California Using Heavy Haulers! Heavy Haulers Transports Machinery from Utah to California Every Day! With our reliable, dependable, and trustworthy team of experts, your LTL shipment will be delivered from California to Utah quickly, safely, and efficiently. As. Shipping from California to Utah ranges from a minimum of miles and 5 hours from Barstow, CA to Cedar City, UT, to over miles and a minimum of 14 hours. Need to ship a car from Utah to California? We have 20+ years of experience. Rates priced to move. Satisfaction guaranteed! Get an instant quote! On-Demand Salt Lake City to Sacramento Courier Delivery Service: 9 hrs 35 min delivery time, miles driving distance on route: I West. California, Colorado, Connecticut, Delaware, District of Columbia, Florida Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming. ZIP Code. Freight rates from California to Utah and freight shipping quotes from CA to UT from FreightPros' team of Truckload & LTL experts. Standard shipping is one of the least expensive methods of mailing packages and going to California may take up to 7–10 business days. You may. The Salt Lake City, UT to Los Angeles, CA route is a mile trip that takes a little over 10 hours of driving to complete. Shipping from Utah to California. Freedom Heavy Haul is your trusted source for heavy haul trucking services between California and Utah. We offer reliable and safe transportation for your. Top 5 routes for car shipping TO Utah ; Utah, California, miles, days, $ ; Utah, New York, miles, days, $ PROVO UT, PROVO UT, PROVO UT, PHOENIX AZ, PHOENIX AZ LOS ANGELES CA, LOS ANGELES CA, INGLEWOOD CA, INGLEWOOD CA, With our new centrally located distribution center in Kansas our rates have dropped and so has the average number of days in transit. FedEx Ground shipments can.

What Insurance Policies Should I Have

What Limits Should I Set on My Policy? The “dwelling” limit should be the amount it would cost to replace your home. This may have nothing to do with the. Insurance companies must offer this coverage to you, but you do not have to buy it. The minimum limit that can be purchased is $1, Physical Damage Coverage. Your need for life insurance depends upon your circumstances, including the financial impacts your death may have on your dependents or loved ones. In the next few pages you will learn about types of coverage available, some tips on how to shop, and what you should do if you need to make a claim. Insurance. should not be relied on in connection with any specific policy or insurer. The cash value: permanent life policies, like whole life insurance, have a. During an insurance review, you should evaluate your home insurance (or renters insurance), car insurance and any other policies you have in your name. When. If budgeting is your biggest concern, term life insurance may be the best choice. If you have many dependents, whole life insurance may be a better route. You've heard it all before. Buying insurance is an act of responsibility, blah, blah · Health insurance · Disability insurance · Critical illness coverage · Life. Should you need or want to purchase homeowners insurance, you will contact an insurance company or an insurance producer (sometimes also known as a broker or. What Limits Should I Set on My Policy? The “dwelling” limit should be the amount it would cost to replace your home. This may have nothing to do with the. Insurance companies must offer this coverage to you, but you do not have to buy it. The minimum limit that can be purchased is $1, Physical Damage Coverage. Your need for life insurance depends upon your circumstances, including the financial impacts your death may have on your dependents or loved ones. In the next few pages you will learn about types of coverage available, some tips on how to shop, and what you should do if you need to make a claim. Insurance. should not be relied on in connection with any specific policy or insurer. The cash value: permanent life policies, like whole life insurance, have a. During an insurance review, you should evaluate your home insurance (or renters insurance), car insurance and any other policies you have in your name. When. If budgeting is your biggest concern, term life insurance may be the best choice. If you have many dependents, whole life insurance may be a better route. You've heard it all before. Buying insurance is an act of responsibility, blah, blah · Health insurance · Disability insurance · Critical illness coverage · Life. Should you need or want to purchase homeowners insurance, you will contact an insurance company or an insurance producer (sometimes also known as a broker or.

Underinsured motorists coverage is similar to uninsured motorist coverage, but pays for your injuries or property damage if the at-fault driver does not have. All policies must be purchased through an agent. You'll also need to speak with an agent to determine coverage limits for policies that you're interested in. The policy covers medical expenses for persons accidentally injured on your property. Most policies do not protect you against losses from floods, earthquakes. Determine what coverage you need and what it will cost. Obtain more than one quote. Do not be rushed into buying a policy by high-pressure sales tactics or be. Use the information on this website to help choose health insurance. This website can also help you understand your health insurance policy. Asset protection: More coverage generally means you will have less to pay out of your own pocket if disaster strikes. You must determine the amount you can. Auto liability coverage; Uninsured and underinsured motorist coverage; Comprehensive coverage; Collision coverage; Personal injury protection. Learn about what. Type of Coverage. Standard Policy. Basic Policy ; Bodily Injury Liability Coverage for claims and lawsuits by people injured as a result of an auto accident you. If no one depends upon you for financial support or you have adequate financial resources, buying life insurance may not be worthwhile. But if your death would. do the type of work you currently do. It's often a good idea to supplement any employer coverage you may have with an additional disability insurance policy. Life insurance can help cover funeral and burial expenses, pay off remaining debts, and make managing day-to-day living expenses less burdensome for those you. The minimum amount of car insurance you'll typically need is state-required liability coverage. This allows you to pay for some, if not all, injuries and. Your auto insurance policy must list all licensed drivers living in Typically, drivers who have their own auto insurance policies can be listed. The policy covers medical expenses for persons accidentally injured on your property. Most policies do not protect you against losses from floods, earthquakes. How Much Homeowners Coverage Do I Need? There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. You may want to purchase this additional coverage if you do not own a car. If you already have a policy with higher liability limits, it will provide the. How do I decide on a life insurance coverage amount? Think about the amount of life insurance coverage you need and the lifestyle you want for your loved ones. Liability Insurance. Georgia drivers must have liability insurance that meets the minimum limits (you can purchase more coverage if you choose) required by law. The Basic Policy should be considered by those with few family responsibilities and few real assets. It can provide a transition for younger drivers who are. These life changes can cause her coverage needs to rise. This need can reach a peak as we continue on to the right—she now could need life insurance to help.

Robinhood Cash Account Day Trade

Utilize a Cash Account: Instead of using a margin account, consider opening a cash account on Robinhood. With a cash account, you can only trade. Any uninvested brokerage cash in your account can earn 5% interest with daily compounding (which helps your money grow faster). Upgrade to its premium. Switch to a cash account. A cash account isn't subject to PDT regulation. This will allow you to continue day trading and participating in the Stock Lending. The goal is to profit from short-term price movements in stocks, options, futures, currencies, and other assets. Day traders typically combine strategies and. A cash account allows you to make day trades at no restriction but will take a couple days for the money to reappear in your account. Pattern Day Traders have to maintain a minimum account balance of $25, in their margin accounts. This allows them to engage in unlimited day trading. Brokers. You'll get a day trade call if you exceed your day trade limit. Your specific day trade limit is based on a specific start of day value. If you didnt know, you need an account balance of $25k to day trade per the SEC, if you dont have that much in your account you will only be. Funds deposited to meet the call must remain in your brokerage account for 2 full trading days before you can withdraw cash. If you withdraw cash while in an. Utilize a Cash Account: Instead of using a margin account, consider opening a cash account on Robinhood. With a cash account, you can only trade. Any uninvested brokerage cash in your account can earn 5% interest with daily compounding (which helps your money grow faster). Upgrade to its premium. Switch to a cash account. A cash account isn't subject to PDT regulation. This will allow you to continue day trading and participating in the Stock Lending. The goal is to profit from short-term price movements in stocks, options, futures, currencies, and other assets. Day traders typically combine strategies and. A cash account allows you to make day trades at no restriction but will take a couple days for the money to reappear in your account. Pattern Day Traders have to maintain a minimum account balance of $25, in their margin accounts. This allows them to engage in unlimited day trading. Brokers. You'll get a day trade call if you exceed your day trade limit. Your specific day trade limit is based on a specific start of day value. If you didnt know, you need an account balance of $25k to day trade per the SEC, if you dont have that much in your account you will only be. Funds deposited to meet the call must remain in your brokerage account for 2 full trading days before you can withdraw cash. If you withdraw cash while in an.

First, pattern day traders must maintain minimum equity of $25, in their margin account on any day that the customer day trades. This required minimum equity. Violating this can restrict the account from further day trades for 90 days. Options to manage day trades include using the day trade counter in the app and. A cash account is not limited to a number of day trades. However, you can only day trade with settled funds. Cash accounts are not subject to pattern day. If you are in a regular cash account then you can place as many day trades as you would like until your cash is used up. The only catch to this is you have to. This Day Trading Risk Disclosure Statement applies to all margin accounts. Cash accounts are not subject to day trading rules. Robinhood Financial LLC and. Unlimited day trades. Cash accounts aren't subject to pattern day trading regulations. · No trading with unsettled funds from stock and options sales. Stocks and. Investing with a Robinhood investing account is commission free. We don't charge you fees to open or maintain your account. Yes, you can day trade on Robinhood just like you would with any other broker. You will still have PDT restrictions if you don't have at least $25, in your. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. When buying securities, the investor must deposit cash to settle the trade, or sell an existing position on the same trading day, so that cash proceeds are. Stocks and options take 1 trading day to settle. In a margin account, you can instantly trade with funds from unsettled stock and option sales. Yes, you can day trade on Robinhood. Functionally, it works the same as investing does. You buy a stock through the app, and then you sell it later on in the. Cash accounts do not have the same restrictions as margin accounts, allowing you to make unlimited day trades without being subject to the PDT. This restriction will be effective for 90 calendar days. Ready to place a trade? Choose an account. Then enter your order. Pattern Day Trading restrictions don't apply to cash accounts—only Instant and Gold accounts. A Robinhood Cash account allows you to place. Even if PDT Protection is disabled, we'll still alert you before you place your 4th day trade in the 5 trading day window. Fee-free crypto trading on 7 major coins · $0 commissions — No fees to enter and exit positions means lower breakeven points on profitable trades. Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. The company provides an electronic trading. Because while waiting for the settlement day, trader can use borrowed money to execute another trade. Accounts with $25k or more, can utilize margin accounts. Round-ups are sent from your spending account with, and are a service of, Robinhood Money. You must spend at least $1 on your Robinhood Cash Card in order to.

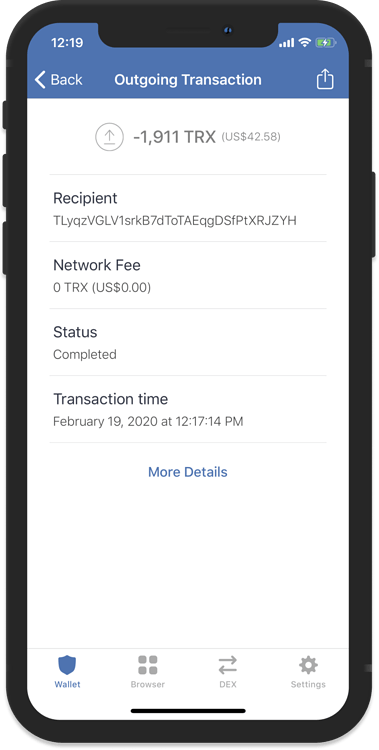

How To Sell Tron On Trust Wallet

Choose a decentralized exchange that supports the swapping of tokens between the Tron and Binance Smart Chain networks. Popular Digital asset. Download Coinbase Wallet to buy and sell Trust Wallet Token on the most secure crypto exchange. TRON blockchains. TWT holders can unlock benefits such. Buy, sell, and swap safely. Convert USD, EUR, GBP, and + other fiat currencies seamlessly to TRX. Sell effortlessly for fiat. Access features like swap and. Buy Trust Wallet Token in Norway in 5 Easy Steps Enter the amount of EUR you'd like to spend. Select EUR from the list of currencies if not pre-selected. The easiest and fastest way to get a crypto wallet is to download Trust Wallet. How to Sell TRON in South Africa? Sign in to your Easy Crypto Account. This means that if you send TRC20 tokens to your wallet, or swap some crypto to a TRC20 token, your TRC20 tokens will not appear. You'll also pay higher. Take advantage of our flexible payment options to sell Tron using a variety of convenient methods including wire transfer, bank transfers and cash withdrawals. Trust Wallet, How to Sell Your Crypto on Trust Wallet, How to Sell Crypto Token on Trust Wallet, How to Sell Floki Trust Wallet. It's easier than ever to pay for services using Trust Wallet. Just enter the merchant TRX recipient address or scan the QR code and complete your transaction. Choose a decentralized exchange that supports the swapping of tokens between the Tron and Binance Smart Chain networks. Popular Digital asset. Download Coinbase Wallet to buy and sell Trust Wallet Token on the most secure crypto exchange. TRON blockchains. TWT holders can unlock benefits such. Buy, sell, and swap safely. Convert USD, EUR, GBP, and + other fiat currencies seamlessly to TRX. Sell effortlessly for fiat. Access features like swap and. Buy Trust Wallet Token in Norway in 5 Easy Steps Enter the amount of EUR you'd like to spend. Select EUR from the list of currencies if not pre-selected. The easiest and fastest way to get a crypto wallet is to download Trust Wallet. How to Sell TRON in South Africa? Sign in to your Easy Crypto Account. This means that if you send TRC20 tokens to your wallet, or swap some crypto to a TRC20 token, your TRC20 tokens will not appear. You'll also pay higher. Take advantage of our flexible payment options to sell Tron using a variety of convenient methods including wire transfer, bank transfers and cash withdrawals. Trust Wallet, How to Sell Your Crypto on Trust Wallet, How to Sell Crypto Token on Trust Wallet, How to Sell Floki Trust Wallet. It's easier than ever to pay for services using Trust Wallet. Just enter the merchant TRX recipient address or scan the QR code and complete your transaction.

Buy Tron · Buy Dogecoin. Sell. Sell Bitcoin · Sell USDT. Crypto wallets. Bitcoin wallet · Binance Coin wallet · Ethereum wallet · Tether wallet · Cardano wallet. Swap your Tron for another cryptocurrency directly in your wallet or by using a DeFi application. Donate. There is a growing number of charities that accept. Download Coinbase Wallet to buy and sell Trust Wallet Token on the most secure crypto exchange. TRON blockchains. TWT holders can unlock benefits such. TRON blockchains. Holders of TWT tokens unlock a variety of benefits when using Trust Wallet, including discounts on in-app cryptocurrency purchases and on. Kraken exchange, make sure you send the TRC20 TRX to the TRC20 deposit wallet and not a BEP20 because it sounds like your TRX is on the TRON. sell USDT: Ethereum, Tron, and Binance Smart Chain. How to sell Tether Do I need to send crypto to an external wallet address to sell USDT via MoonPay? Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). Sell TRON - TRX via Trust wallet through our safe marketplace. Large network of local traders across the globe available for P2P TRON / Trust wallet trades. Buy, sell or swap Trust Wallet Token (TWT) safe & easy? ✓ Earn up to 15% per year with Earn & Staking ✓ + cryptocurrencies ✓ Download the App. How to swap TRON to Trust Wallet Token? ·. Choose the desired crypto pair. ·. Input the amount of TRON. ·. Compare the rates. ·. Click on the exchange button. Choose Tether USD (Tron) in the “You send” section. Next, enter the amount of USDTTRC20 you would like to exchange. Then select Trust Wallet Token in the “You. To swap USDT from TRON to Binance Smart Chain (BSC) in Trust Wallet, first open Trust Wallet and ensure both TRON and Binance Smart Chain. The current 1 TRON to Trust Wallet Token exchange rate is TWT. There are no limits to TRX to TWT swaps here, so feel free to use ChangeNOW no matter how. - Send, Receive, Buy and Sell your NFTs within Trust Wallet. - Binance TRON Wallet Support (TRX) Tron staking is now available. Bittorrent (BTT). Tron network, worth $- at the current market rate. To delegate your tokens, you should ensure they are stored on your Ledger or Trust Wallet, and then follow. Trust Wallet is a multi-chain self-custody cryptocurrency wallet and secure gateway to thousands of Web3 decentralized applications (dApps). Open Trust Wallet App; Tap on Add Tokens; Enter Tron in the search bar and find the TRX token; Choose toggle blue. sell their work directly to customers, with the system powered by its Unfortunately, Trust Wallet is another wallet that doesn't yet support Tron NFTs. So, you've converted 1 TRON to Trust Wallet Token. We used International Currency Exchange Rate. We added the most popular Currencies and. In our list here, Trust Wallet supports Tron and its TRC20 tokens. Also, Exodus has a mobile and desktop wallet that supports these tokens. So USDT traders can.

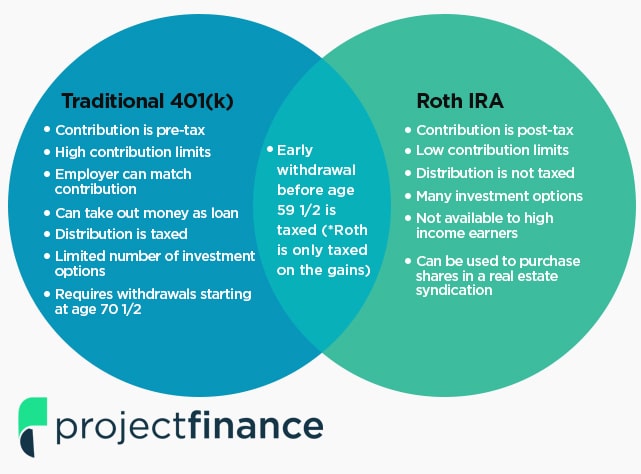

How To Calculate Roth 401k Contribution

The main difference is the timing of taxation. Similar to Roth IRAs, Roth (k)s are retirement plans that utilize after-tax contributions instead of pre-tax. Should you invest in a traditional k or a Roth k? It depends on a number of factors. Use our k calculator to help understand the differences. Contributions made to a Roth (k) account are made on an after-tax basis, which means that taxes are paid on the amount contributed in the current year. The. For example, let's assume your employer provides a 50% (k) contribution match on up to 6% of your annual salary. If you have an annual salary of $, and. Choose either the percent of your gross salary contribution or your per pay dollar contribution. Do NOT include any employer match or your spouse/partner's. This is either Roth or Traditional. If you choose 'Roth' the calculator will increase the assumed contribution to your 'Traditional' option to equal the same. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to. Example of How a Reduced Limit Is Calculated · MAGI: $, · $, - $, = $3, · $ ÷ $15, = · * $6, = $1, · $6, - $1, If you choose 'Traditional' the calculator will decrease the assumed contribution to your 'Roth' option to equal the same net take home pay. The main difference is the timing of taxation. Similar to Roth IRAs, Roth (k)s are retirement plans that utilize after-tax contributions instead of pre-tax. Should you invest in a traditional k or a Roth k? It depends on a number of factors. Use our k calculator to help understand the differences. Contributions made to a Roth (k) account are made on an after-tax basis, which means that taxes are paid on the amount contributed in the current year. The. For example, let's assume your employer provides a 50% (k) contribution match on up to 6% of your annual salary. If you have an annual salary of $, and. Choose either the percent of your gross salary contribution or your per pay dollar contribution. Do NOT include any employer match or your spouse/partner's. This is either Roth or Traditional. If you choose 'Roth' the calculator will increase the assumed contribution to your 'Traditional' option to equal the same. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to. Example of How a Reduced Limit Is Calculated · MAGI: $, · $, - $, = $3, · $ ÷ $15, = · * $6, = $1, · $6, - $1, If you choose 'Traditional' the calculator will decrease the assumed contribution to your 'Roth' option to equal the same net take home pay.

A Roth (k) plan is an after-tax contribution. Using the same example above of a paycheck of $1,, your withholding taxes are calculated on $1, When. (k) or (b) plan to which designated Roth contributions are made An employer may use designated Roth deferrals in calculating a matching contribution. This calculator helps you estimate the earnings potential of your contributions, based on the amount you invest and the expected rate of annual return. Personal. Use PaycheckCity's k calculator to see how k contributions impact your paycheck and how much your k could be worth at retirement. By comparision, Roth (k) contributions are after-tax, which means that you do not receive this tax break during your working years. A traditional (k). Do you have a (k) or (b) retirement plan with your employer? If you Roth or traditional: Which is right for you? It all comes down to how and. Is converting to a Roth IRA the right move for you? This calculator can help you decide if converting money from a non-Roth IRA(s) — including a traditional. If you have an annual salary of $, and contribute 6%, your contribution will be $6, and your employer's 50% match will be $3, ($6, x 50%), for a. To convert to Roth, you would pay approximately $12, in taxes today, but in 20 years, you could have $22, more in total assets, which may make a Roth. (k), Traditional IRA, Roth IRA, Roth (k), SEP, SIMPLE or Keogh plan. Please note that the maximum contribution limits displayed for each plan are only. Definitions · Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage. · Subtracting the value of allowances allowed . IRA Contribution Calculator, Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you. Contributions made to a Roth (k) or IRA are made on an after-tax basis, which means that taxes are paid on the amount contributed in the current year. The. Annual contribution ($7, max) Your contribution amount depends on your filing status and annual income. The calculator will adjust automatically based on. Traditional (k) vs. Roth Contribution Calculator · Which option is right for me? · Connect with a Financial Professional. An employee can put up to $18, into a k (or $24k if they're over 50). The employee says 'contribute 10%'. That amount is calculated on. Traditional (k) Calculator. A (k) contribution can be an effective retirement tool. As of January , there is a new type of (k) - the Roth (k). Use this calculator to help compare employee contributions to the new after-tax Roth (k) and the current tax-deductible (k). Traditional or Roth contributions? Use this calculator to help determine which one is better for your situation. With the passage of the 'American Tax Relief Act', any (k) plan that allows for Roth contributions will now be eligible to convert existing pre-tax.